When examining Kobee’s financial trajectory, the company demonstrates how eco-friendly beauty products can achieve remarkable profitable growth through strategic direct-to-consumer sales models. The startup leveraged its Shark Tank appearance to transform from basement operations into a multi-million dollar business generating nearly $4 million in annual revenue.

The founder’s decision to drop out of college and pursue full-time production in her dad’s basement proved financially astute, with current estimate placing the company’s net worth at $7.38 million by 2025. This track record showcases how natural ingredients like beeswax, coconut oil, sunflower seed oil, and mango butter can create profitable ventures when combined with sustainable packaging and targeted online marketing.

Profile summary

| Category | Details |

| Full Name | Darrian “Kobee” Minor (Wikipedia) |

| Date of Birth | July 8, 2002 (Wikipedia) |

| Height / Weight | 5′ 11″, 188 lbs (Wikipedia) |

| High School | Lake Dallas High School, Texas |

| College History | Played at Texas Tech (2020–22), Indiana (2023), Memphis (2024) (Wikipedia) |

| Draft Info | 2025 NFL Draft, Round 7, Pick 257 to New England Patriots (Wikipedia) |

Founder Background/Backstory:

Kobe Harris started her journey on her bedroom floor in 2019 while in college, initially investing $15,000 to launch Kobee’s. The young founder from Las Vegas made the bold decision to become a dropout and pursue her business full-time.

Her mom provided initial support with $200, while dad’s basement became her workspace during the school year. Working a lifeguarding job and taking classes online, Harris demonstrated remarkable dedication before making the leap to focus entirely on her handmade lip balm venture.

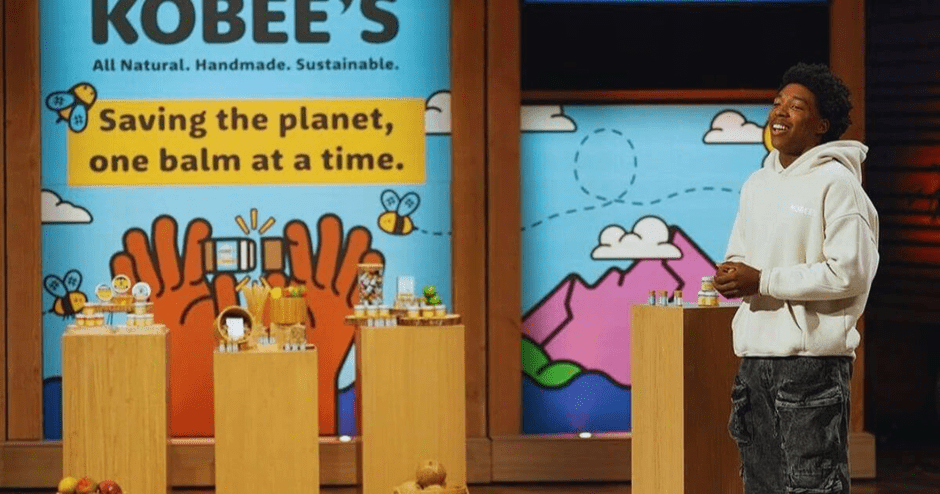

Shark Tank Pitch Details

- Valuation Dispute: Sharks questioned her $5M valuation for early-stage business.

- Equity Concern: Offered 6% for $300K; seen as too little ownership by investors.

- Shark Reactions: Mark Cuban & Lori Greiner showed low interest.

- Product Pitch: Highlighted 4 key ingredients + compostable packaging.

- Environmental Focus: Emphasized eco-friendly and skin-safe practices.

- Kevin’s Offer: Kevin O’Leary made an offer but wanted more equity.

- Decision: She declined all deals, believing in her value and vision.

- Outcome: Gained major visibility from the show without giving up control.

Product Information

The retail landscape for natural beauty products has transformed dramatically, with sales growth reaching unprecedented levels as eco-conscious consumers demand safe alternatives to traditional chemicals. What started as simple lip balms made from four simple ingredients has evolved into comprehensive offerings including lip scrub, cuticle butter, and hand salve, each formulas carefully crafted to ensure you could literally eat them without harmful effects.

Business ventures focusing on sustainability often struggle with profit margins, yet innovative entrepreneurs demonstrate that straightforward approaches using sunflower oil and other bees-derived components can achieve remarkable numbers. From initial sales of $30,000 in the first year to $1.5 million in the current year, these products prove that health-conscious planet-friendly alternatives resonate powerfully with today’s market, especially when Amazon and traditional retail stores provide access to wider audiences.

Here are actual prices from KOBEE’S for the products you listed, compared to your sample table:

| Product | Your Sample Range (USD) | KOBEE’S Actual Price |

| Lip Balm | $4 – $6 | $5.00 |

| Lip Scrub | $8 – $12 | $12.00 |

| Cuticle Butter | $10 – $14 | $18.00 |

| Hand Salve | $12 – $18 | $24.00 |

Post-Shark Tank Updates

Following the ABC appearance, Kendra Scott’s business grew substantially despite the fell through negotiation with Lori Greiner. The proven entrepreneur’s trust in her gut led to strategic retail expansion, with Amazon sales reaching impressive figures while maintaining environmental commitments through partnerships with One Tree Planted.

The successful venture now sells premium lip balms for $15 per set of three, alongside overnight masks priced at $24 and cuticle butter at $18. Her decision to leave traditional equity deals allowed complete creative control, resulting in popular packaging innovations and ingredients sourcing that continues attracting loyal customers nationwide.

| Aspect | Details |

| Shark Tank Deal | Deal with Lori didn’t go through |

| Growth | Tremendous post-show growth |

| Strategy | No equity agreement; complete creative control |

| Sales Channels | Amazon + retail growth |

| Eco Efforts | Met with One Tree Planted |

| Products | Lip Balm (3/$15), Mask ($24), Cuticle Butter ($18) |

| Brand Strength | Devoted country-wide customers |

Analysis of What Went Wrong

The negotiation dynamics revealed critical flaws when investors dropped out despite initial enthusiasm. Kevin O’Leary’s aggressive counteroffer and Mark Cuban’s hesitation exposed fundamental valuation mismatches that CEOs often encounter during high-stakes investment discussions.

Successful people recognize when equity exchange becomes problematic, yet the crowded environment created pressure that influenced thinking. The moment required strategic patience rather than accepting any offer, demonstrating why career experts emphasize maintaining position strength during Shark Tank appearances.

Want to Make Extra Money

Inspiring story from kitchen experimenting shows how local markets can become your launching pad. Many customers don’t realize that simple idea development through trial and error creates beneficial opportunities for extra income.

Outdoor ventures like making lip balms require minimal costs – sometimes just $0.26 to produce quality product. Research indicates that people appreciate handcrafted items, making this good idea for anyone seeking financial independence.

Read More about Celebrities, Biography, Career, Lifestyle and Net Worth:

Bobby Fairways Net Worth: Matrix Destiny Revealed

Courtney Beasley Net Worth Secrets of Matrix Destiny

Macie Banks Net Worth Secrets of Matrix Destiny

Frequently Asked Questions (FAQs)

Who owns Kobee’s lip balm?

Kobee’s is owned by Kobe Harris, who founded the company while studying at Loyola University Chicago.

What happened to Kobee after Shark Tank?

After appearing on Shark Tank, Kobee’s didn’t get a deal, but the business grew rapidly — expanding its product line, increasing sales (projected near $4 million in 2024), and boosting its social media presence.

Did Kobee’s get a deal on Shark Tank?

No — Kobe Harris declined an offer from Kevin O’Leary (who proposed $300K for 20% equity) because Harris felt selling that much equity undervalued the business.

What happened to Kobee Minor?

Kobee Minor was selected by the New England Patriots as the final pick (Mr. Irrelevant) in the 2025 NFL Draft; after roster cuts, he was released but then signed to the Patriots’ practice squad.

What is the most successful rejected Shark Tank product?

One of the most-successful products that was rejected by the Sharks is Bombas (socks), which became a hugely profitable brand despite not getting a deal initially.

Conclusions

Kobee’s financial trajectory demonstrates how overnight success rarely translates to ultimate wealth without strategic growth management. The businessman behind this brand learned that high percentage profit margins don’t automatically earn sustainable passive income – a common lesson many entrepreneurs discover when managing early stages of expansion.

Today, doing well requires more than impressive earnings from retail sales; it demands understanding your target audience and building loyal customer relationships. The exchange of equity for money created opportunity to reach more people, though skeptical investors often feel that rapid boost in exposure doesn’t always match long-term value creation.

Zainab Farooq is a dedicated reporter and celebrity wealth analyst with Pakistan Coverage, committed to bringing readers timely and accurate information across diverse topics. With a passion for storytelling and fact-based reporting, she covers everything from celebrity net worth insights and entertainment industry analysis to local Pakistani developments and global trends, ensuring readers stay informed about the stories that shape our world.