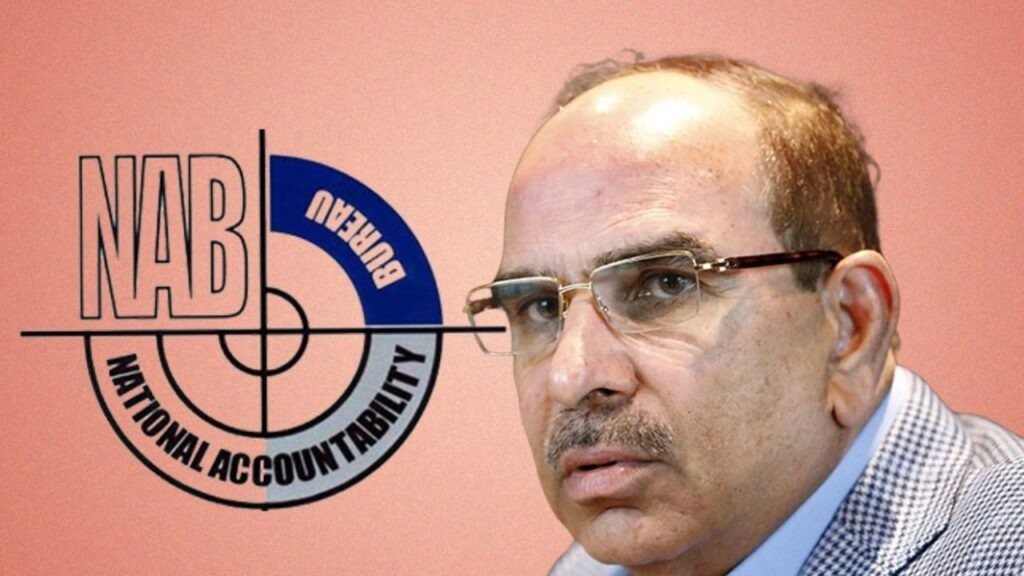

The NAB public auction August 7, 2025 now has full backing after the Islamabad High Court approval authorising the Malik Riaz Bahria Assets Auction Approved by IHC. This marks a significant moment in Pakistan’s push for NAB fund recovery and major asset liquidation. The court cleared legal hurdles, allowing NAB to sell high‑value Bahria Town assets including Plot 7 D and Plot 7 E, plus commercial and educational properties tied to Malik Riaz. The ruling sets the stage for a transparent legal process and signals that government agencies can now proceed with confidence in recovering public dues. Interested buyers should stay alert. For more latest news checkout, Pakistan coverage.

Background

The Auction of Malik Riaz properties reached a critical milestone when the Islamabad High Court approval arrived, clearing legal hurdles and confirming the NAB auction will now proceed. Furthermore, NAB now prepares for a public sale of properties backed by expert legal authority. Meanwhile, the court’s ruling ends the earlier stay and affirms the IHC green light auction for all listed assets. This decision marks an inflection point in Major asset liquidation and NAB fund recovery in Pakistan. Subsequently, it paves the way for transparent liquidation efforts tied to Bahria Town assets.

At the same time, the approval follows the dismissal of petitions challenging NAB’s move. Indeed, the Asset attachment under plea bargain in the £190 million Al‑Qadir Trust case triggered this process. Moreover, Malik Riaz and his son defaulted on their obligations. As a result, NAB launched legal recovery. Therefore, the court order secured the path for NAB to sell Bahria Town assets linked to Plot 7 D, Plot 7 E and other properties. Consequently, the NAB to sell Bahria Town assets initiative continues without interruption.

Auction Details

The NAB public auction August 7, 2025 will take place at NAB’s Rawalpindi Office in G‑6/1, Islamabad. Also, it includes key Bahria Town assets such as Bahria Town Corporate Office buildings on Plot 7 D and Plot 7 E in Phase II. Additionally, NAB invited prospective buyers well in advance to support a Transparent auction process. The venue is ideal for those focused on Rawalpindi Islamabad real estate. Therefore, this rare event presents a clear example of Major asset liquidation under IHC green light auction authority.

Moreover, the auction notice lists assets like Arena Cinema, Safari Club, International Academy, and the Rubbish Market & Lawn near Bahria Garden City Golf Course. In fact, the notice outlines the Auction of Malik Riaz properties narrative fully. NAB also emphasises that Buyer registration for auction guidelines will be released soon. In effect, this structure enhances the High profile real estate sale Islamabad and ensures bidders can prepare documentation, deposits, and inspection plans ahead of time.

Corporate Offices

NAB plans to auction Bahria Town Corporate Office buildings on Plot 7 D and Plot 7 E, valued at approximately Rs 871 million and Rs 881 million respectively. These offices are central to the Auction of Malik Riaz properties campaign. Furthermore, they anchor the NAB to sell Bahria Town assets initiative. Also, the location on Park Road is highly accessible and listed prominently in the Bahria Town assets map. Hence, this inclusion demonstrates the scale of this Major asset liquidation, drawing interest from local and national investors.

Public Attractions

Part of the offering includes Arena Cinema and Safari Club, both commercial landmarks in Bahria Town Rawalpindi. Moreover, this reflects NAB’s intent to liquidate high-value real estate publicly. Indeed, this part of the Auction of Malik Riaz properties highlights how NAB fund recovery efforts target prominent public attractions tied to Bahria Town assets. Consequently, these assets attract bidders seeking commercial revenue in a High profile real estate sale Islamabad environment.

Educational & Land Assets

Also included are the Bahria Town International Academy and the Rubbish Market & Lawn near Bahria Garden City Golf Course. These assets further broaden NAB’s sweep of diverse Bahria Town assets, addressing obligations from the Al‑Qadir Trust case. Meanwhile, the Auction of Malik Riaz properties now spans institutional and undeveloped land. Therefore, these offerings bring varied investment options into the High profile real estate sale Islamabad and diversify the Major asset liquidation mix.

Legal Context

The foundation of this action lies in the Asset attachment under plea bargain stemming from the £190 million Al‑Qadir Trust case. Malik Riaz and his son defaulted on their payment commitments. Therefore, NAB invoked Section 33E of its ordinance to begin NAB fund recovery. Initially, IHC imposed a stay on the sale; subsequently, it lifted that hold, granting the IHC green light auction and authorising NAB to proceed. Hence, the legal basis now drives the NAB public auction August 7, 2025 forward.

Meanwhile, NAB’s legal team argued the auction is lawful and essential. Conversely, Bahria Town lawyers labelled the move as “illegal, deceptive.” However, the court sided with NAB, endorsing the NAB to sell Bahria Town assets strategy. As a result, this ruling sets legal precedent around Recovery of public funds and benchmarks how a public sale of properties should proceed under accountability rules.

Reactions & Responses

Malik Riaz issued a statement and X post warning Bahria Town operations could collapse. He claimed government action had disrupted operations nationwide, freezing billions of rupees in investments. Meanwhile, the Auction of Malik Riaz properties became a flashpoint amid broader debate over the Bahria Town legal dispute and investor confidence. He offered arbitration and sought a dignified resolution. Thus, his response underscores risks related to public trust in ongoing sales and the implications for a High profile real estate sale Islamabad.

On the other hand, NAB reasserted that the auction is fair and follows legal norms. Moreover, it cited payment defaults and defended the Asset attachment under plea bargain steps. Officials also promised a Transparent auction process and confirmed rights for inspection before Buyer registration for auction. Hence, they pressed that this move aligns with public interest by enabling Recovery of public funds and ensuring Major asset liquidation occurs within clear legal frameworks. To Discover trending tech news and innovations, click here.

Process & Payments

NAB has outlined a strict payment schedule. Winning bidders at the NAB public auction August 7, 2025 must pay 5 % on auction day, 10 % within one month, and the remaining 85 % within three months. Consequently, this structure drives swift NAB fund recovery and discourages defaults. Also, it supports standards for a Transparent auction process. This timeline reflects NAB’s resolve to implement its NAB to sell Bahria Town assets scheme while safeguarding public resources through tight fiscal oversight.

Moreover, detailed Buyer registration for auction guidelines will be published soon. Prospective bidders must prepare to register, submit deposits, and inspect assets like Plot 7 D, Plot 7 E, Arena Cinema, Safari Club, International Academy, and Rubbish Market & Lawn. Thus, this method upholds the integrity of a High profile real estate sale Islamabad event and reinforces trust in its Recovery of public funds and overall public sale of properties process.

Market Implications

This Major asset liquidation in the Rawalpindi Islamabad real estate sector may shift investor sentiment. Selling high‑value Bahria Town assets signals accountability and could cool speculative pricing in Islamabad‑Rawalpindi. Meanwhile, new buyers may see the Auction of Malik Riaz properties as an opportunity to secure premium assets at potential discounts. Consequently, supply-and-demand dynamics within Bahria Town developments may change. Moreover, broader implications include increased scrutiny on large developers. Analysts view the NAB to sell Bahria Town assets effort as precedent for future public sale of properties tied to legal settlements. As a result, real estate stakeholders foresee ripple effects: stricter due diligence, cautious financing, and closer collaboration between regulators and developers in future High profile real estate sale Islamabad ventures. Ultimately, it will show whether confidence in Recovery of public funds through such auctions holds steady over time. To Get all the news and updates from Pakistan, click here.

Frequently Asked Questions (FAQs)

Who is the owner of Bahria?

The owner of Bahria Town is real estate tycoon Malik Riaz, the founding chairman of the company and visionary behind its development.

What is the price of plot in Bahria?

A 10‑marla plot in Bahria Town Rawalpindi typically starts around Rs 50 lacs, with prices varying by phase and development status.

Who is the richest person in Lahore?

The richest person from Lahore is Shahid Khan, a Pakistani‑American billionaire with a net worth estimated at $11.6 billion.

Who is the CEO of Bahria Foundation?

The CEO (Managing Director) of Bahria Foundation is Vice Admiral (R) Shah Sohail Masood, a retired senior officer of the Pakistan Navy.

How rich is Malik Riaz?

Malik Riaz is estimated to be worth between $1.4 billion and over $2.5 billion as of 2025, placing him among Pakistan’s wealthiest real estate figures.