John C Miller has built substantial financial success through strategic ventures spanning tech industries and food service innovation. His estimated net worth of $13 million to $20 million reflects diverse income streams from CEO compensation, equity in startups like Miso Robotics, and long-term strategic investments that foresee emerging market trends.

The SVP and President roles at Macaroni Grill under Brinker International Inc, where he owns 59,664 shares of EAT stock valued at $8 Million, complement his Director position at Denny’s Corp with 740,626 shares of DENN stock worth $4 Million. His ability to shape consumer experience through technology has positioned him as a leading innovator whose value extends beyond traditional Holdings Summary metrics from SEC filings.

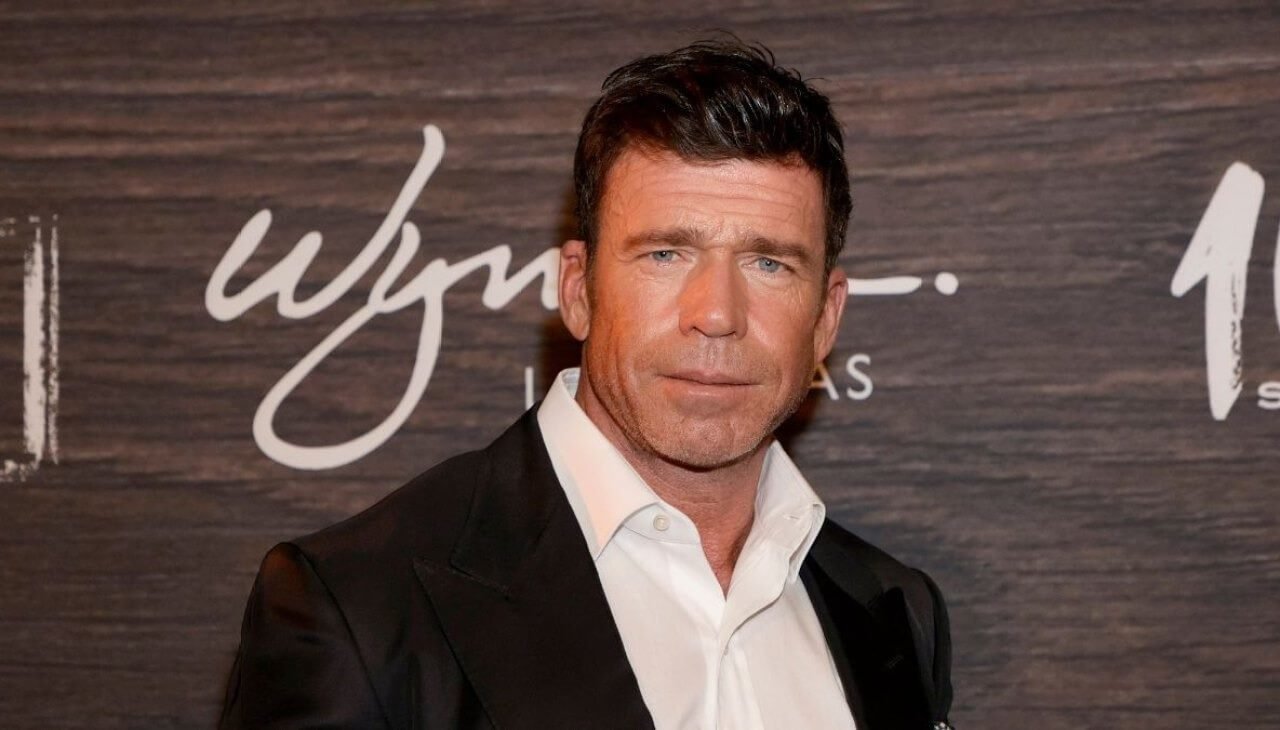

John Miller: Profile Summary

| Category | Details |

|---|---|

| Full Name | John C. Miller |

| Birth | 1978, Los Angeles, California |

| Primary Roles | CEO of CaliGroup & PopID, Entrepreneur, Innovator |

| Key Ventures | Miso Robotics, CaliBurger, Kitchen United, Super League Gaming |

| Major Assets | 59,664 shares in Brinker International (EAT); 740,626 shares in Denny’s Corp (DENN) |

| Education | JD, Stanford Law School; BA in Economics |

| Career Transition | From Law and Intellectual Property to Technology and Business Leadership |

| Major Achievements | Introduced Flippy robotic kitchen assistant, advanced biometric payment systems (PopID), secured global partnerships (FIFA, White Castle, Whataburger) |

| Industry Influence | Recognized leader in Food Tech Innovation, AI-driven Automation, Biometric Payments |

| Recognition | Seen as a visionary entrepreneur transforming dining and retail technology |

| Personal Life | Maintains privacy in family and personal matters |

Early Life and Education

- Full Name: John Gilbert Miller

- Date of Birth: 1978

- Birthplace: Los Angeles, California, USA

- Nationality: American

- Early Life: Grew up in California in a supportive family with a focus on academics and business.

- Education: Attended the University of Redlands for undergraduate studies.

- Higher Education: Earned a law degree (J.D.) from Stanford Law School.

- Early Interests: Passionate about business management and corporate law.

John C. Miller’s educational background laid a foundation for his career, earning a BA in Economics that would later translate into business ventures. This expertise at the intersection of science and commerce became a cornerstone for his entrepreneurial drive. His academic journey equipped him with legal acumen to navigate intellectual property complexities in emerging technology sectors.

The transition from theoretical economics to practical applications showcased his grounded personality and professional dedication. Miller’s early years remain relatively private, as he prefers to maintain a low profile regarding personal life details. His background in economics helped shape analytical thinking patterns that would prove essential in leadership roles. The groundwork established during these formative years enabled him to merge financial understanding with innovation. This period set out the intellectual tools necessary for showcasing futuristic mindset approaches.

John Miller Net Worth

John C. Miller’s financial standing reflects his entrepreneurial ventures across technology and restaurant sectors. His worth ranges to approximately $11 million as of 2025, primarily from companies like Miso Robotics and PopID. His investments in CaliBurger, Kitchen United, and Super League Gaming contribute substantially to overall wealth accumulation. The founder’s stake in facial recognition payment systems positions him strategically for future market expansion. His business acumen in automation and AI technologies drives continued revenue growth across multiple ventures. Industry analysts value his diversified portfolio through strategic leadership and innovative tech deployments.

Miller’s wealth stems from founding tech companies and strategic board positions plus intellectual property licensing income. His early work at Arrowhead Pharmaceuticals as vice president established foundational patent law expertise generating ongoing streams. The Pasadena-based CaliGroup, his primary holding company, oversees diverse portfolio companies with substantial revenues annually. His leadership in deploying Flippy robotic systems across 50 CaliBurger locations and 100 White Castle sites demonstrates scalable business strategy. Market analysts note his biometric payment partnerships with Visa and J.P. Morgan Payments could potentially increase net worth if PopID achieves widespread adoption in retail and hospitality sectors.

| Year | Net Worth | Primary Wealth Sources |

| 2018 | $6-7 million | CaliGroup holdings, CaliBurger expansion, PopID launch |

| 2020 | $8-9 million | Miso Robotics growth, Flippy deployments, pandemic technology adoption |

| 2022 | $9-10 million | FIFA World Cup PopID implementation, White Castle contracts, international CaliBurger locations |

| 2024 | $10-11 million | Expanded biometric payment partnerships, Flippy 2.0 rollout, retail technology licensing |

| 2025 | $11 million | Consolidated automation standards, global PopID presence, diversified tech portfolio |

| Overall Estimated Value | $11 million | Technology ventures, intellectual property, restaurant holdings, biometric systems |

John Miller Personal Life

- Father: Known to be a businessman

- Mother: Homemaker

- Wife: Previously married to Caroline Campbell (violinist)

- Current Partner: Jennifer Garner (actress)

- Children: Two children (a son and a daughter) from his marriage to Caroline Campbell

John C. Miller’s partner and relationship status has attracted public attention beyond his business ventures. While maintaining privacy around personal milestones, Miller has occasionally shared glimpses of his life outside boardrooms. His reputation extends beyond corporate achievements, reflecting a balanced approach to professional and private spheres. Raised in Los Angeles, his California roots continue to influence his West Coast-centric business philosophy. Despite being born in 1978, he keeps family details carefully guarded from media scrutiny.

His young age success story reveals someone who managed to innovate across multiple industries while maintaining personal boundaries. The intersection of his high-profile business legacy and private life demonstrates careful navigation of public interest. His approach to balancing recognition with discretion has become a model for tech entrepreneurs. Miller’s personal values align with his professional mission—creating seamless, efficient systems that respect individual privacy while promoting technological advancement in everyday experiences.

Transition From Law to Business

After earning his JD from Stanford Law School and being admitted to the California Bar, he spent years navigating business law with academic excellence. His legal education provided a competitive edge when he transitioned from traditional intellectual property roles into tech innovator positions. The pioneering career shift happened during the early 2010s when he became a driving force behind Cali Group, a tech-driven holding company focused on restaurant industry transformation.

Career Journey Highlights

- In the 2000s, began practicing law with a focus on intellectual property.

- CaliGroup was founded in 2011 with an emphasis on tech-driven restaurant innovation.

- In 2016, Miso Robotics was founded, and the Flippy kitchen robot was introduced.

- 2017–2020: CaliBurger and PopID were expanded, introducing biometric payments and AI-powered dining systems.

His vision extended beyond conventional legal practice as he began revolutionizing how consumers experience dining and payments. The fast-food sector became his testing ground where law met technology and innovation. Through Caliburger and other flagship ventures, he proved that instrumental knowledge of business law could elevate convenience while helping restaurants adapt to the digital era. This forward-thinking model turned him into a leading figure in consumer-facing innovation, with his achievements spanning streamline operations through biometrics and AI-powered order kiosks.

Calibuger

Caliburger became the restaurant where Miller helped establish advanced Robotics for kitchen operations. The Flippy Robot-on-a-Rail, or Flippy ROAR, was an upgraded version designed to automate grilling and frying tasks. This groundbreaking initiative deployed a robotic device that handled food preparation with remarkable consistency. Trials at a single location in San Diego proved the robotic kitchen assistant could fry burgers efficiently. Time magazine recognized it among the best inventions, validating this faster, more versatile approach to food service.

- CaliGroup’s tech-driven restaurant vision led to its founding in 2011.

- Headquartered in Pasadena, California, with offices worldwide.

- Created the Flippy Robot to automate tasks like frying and grilling.

- Time Magazine recognized it, and in 2020 it was displayed at Dodger Stadium.

The technology addressed labor cost reduction while maintaining superior hygiene standards since robots don’t spit or contaminate food. Implementation at Dodger Stadium in July 2020 as a food concession showcased large-scale restaurant kitchen potential. The vision extended beyond automation, targeting fundamental operational systems challenges within the fast-food sector. During the COVID-19 pandemic, this contactless approach aligned perfectly with enhanced food safety protocols. The robotic integration helped shape a new paradigm, becoming a symbol of how efficiency transforms establishments. Chicago restaurants and Fountain Valley locations installed similar systems, inspiring a wave of interest across the industry.

Restaurant Kitchen Robotics

Miso Robotics emerged as a technology company reshaping how fast-food operations integrate robotics into their kitchen workflows. The company introduced Flippy, an automated system designed to handle repetitive cooking tasks in restaurant environments. This subsidiary approach to kitchen automation aims to drive down costs while maintaining increased quality standards. Innovative technology like facial recognition-inspired sensors helps robots navigate busy kitchen spaces safely.

Miso Robotics: Revolutionizing Kitchen Automation

- Established in 2016 with the goal of advancing restaurant automation.

- Headquartered in Pasadena, California, and operating worldwide.

- Created the Flippy Robot to prepare fast food like burgers and fries.

- Focuses on AI-driven frying stations that assist staff.

Invested heavily in research, the firm developed solutions that address chronic staffing challenges facing the food service sector. Innovations include automated frying stations that work alongside human staff rather than replacing them entirely. The systems can check temperatures precisely and maintain consistency during peak hours. Jeffrey Kalt recognized early that Millennials seek entertaining workplace experiences, making human-robot collaboration essential for modern fast-casual operations.

Popid CEO

His net worth remains a subject of speculation, with insider information being the most reliable gauge. A Form 4 filing dated 2024-02-26 reveals his currently holds position in listed stock. The actual net worth extends beyond public disclosures, as private purchases and sales of common stock occur regularly. Transaction code P indicates acquisitions, while S marks disposals. The Disclaimer section notes that final shares held through open market activities may shift valuations significantly.

Popid CEO Journey Highlights

- Became PopID’s CEO in the mid-2010s, spearheading advancements in biometric payments.

- Acquisitions and disposals of stocks were confirmed by an SEC filing in February 2024.

- The value of the portfolio is still complex because its assets are not publicly available.

As of 2025-10-04, precise figures require careful analysis of multiple insider documents. His portfolio’s complexity means any estimate must account for unlisted assets and corporate holdings. Smart investors know the stock valuations tell only part of the story.

Recognition and Business Impact

Miller’s executive figure status has positioned him as a key innovator where tech meets traditional retail. His business ventures have gained significant public attention, particularly through strategic partnerships with major players like FIFA and high-profile businesses. The formed alliances with Whataburger showcase his ability to merge cutting-edge biometric solutions into mainstream services. His approach has effectively redefined how consumers experience contactless payments across multiple sectors.

Backed by substantial investment, Miller’s ventures have received praise for their potential to transform public infrastructure. The realm of facial recognition technology has expanded dramatically under his leadership, working to implement systems that eliminate the need for traditional payment methods. His involvement in major events like the 2022 FIFA World Cup and Miami Grand Prix has proven the viability of biometric payment systems. The seamless integration of these biometric identity solutions has already begun helping businesses build more efficient operations.

Legacy and the Road Ahead

Miller’s innovation trajectory showcases how legal expertise can transform traditional industries while creating sustainable frameworks. His forward-looking approach combines cutting-edge technology with customer experience, disrupting how people interact with physical spaces. The firm foundation in law enables him to translate complex ideas into viable business models rather than merely following trends. His work continues to influence the global scale of food tech, shaping modern dining experience standards.

Shaping the post-pandemic economies requires committed leaders who can create impactful change through futuristic mindset applications. Miller’s contributions remain strong across multiple ventures, from biometric payment systems to kitchen robot deployments. His ability to manage both high-profile relationship dynamics and professional journey demands speaks volumes about balanced priorities. This lasting legacy emerges from staying committed to groundwork principles while promoting technological advancement that leaves industries permanently altered.

Read More

- JB Mauney – Career highlights of the legendary bull rider

- Gary Brecka Net Worth – How the health expert built his fortune

- Joey Stax – His journey, lifestyle, and influence

Frequently Asked Questions (FAQs)

How much does John Miller make?

John Miller’s exact earnings are not publicly disclosed.

How rich is the Miller family?

The Miller family is considered very wealthy, with diverse assets.

What is John Miller known for?

He is known as a successful businessman and entrepreneur.

Does John Miller have other business ventures?

Yes, he has investments in multiple industries.

Where does the Miller family live?

They reside primarily in the United States.

Dua Mahfooz is an experienced journalist and financial analyst for Pakistan Coverage, specializing in celebrity net worth analysis, entertainment industry trends, and breaking news. With expertise in wealth assessment and market research, she provides accurate financial insights on public figures alongside comprehensive coverage of political, economic, and social developments. Her commitment to thorough research and fact-checking ensures reliable, well-sourced content across diverse topics.